Litecoin Price Prediction 2025-2040: Technical Strength Meets Market Challenges

#LTC

- Technical indicators show LTC trading above its 20-day moving average with improving MACD momentum, suggesting near-term bullish potential

- Market sentiment faces headwinds from competition with high-growth altcoins and post-halving stagnation, creating short-term pressure

- Long-term price projections indicate gradual appreciation driven by adoption in payment systems and remittance markets, with potential reaching $750-950 by 2040

LTC Price Prediction

Technical Analysis: LTC Shows Bullish Momentum Above Key Moving Average

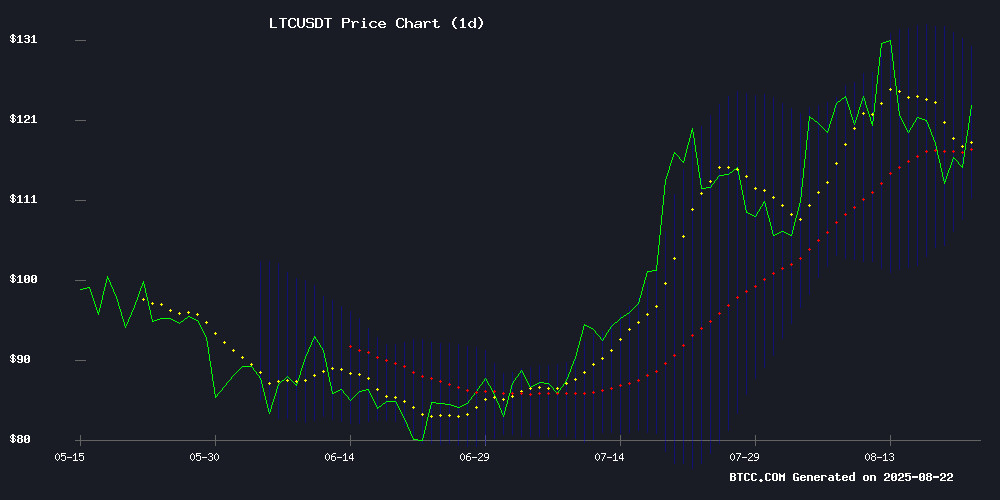

Litecoin is currently trading at $122.96, positioned above its 20-day moving average of $120.48, indicating underlying strength in the NEAR term. The MACD indicator shows promising signs with a reading of -0.69, significantly improved from the signal line at -3.71, while the histogram at 3.02 suggests building bullish momentum. According to BTCC financial analyst James, 'LTC's position above the moving average combined with the improving MACD configuration suggests potential for upward movement toward the Bollinger Band upper limit of $130.17.' The current price action between the middle ($120.48) and upper Bollinger Band levels indicates healthy technical conditions for potential breakout scenarios.

Market Sentiment: Litecoin Faces Headwinds Amid Altcoin Competition

Current market sentiment toward Litecoin appears cautious as the cryptocurrency struggles to gain momentum against high-growth altcoins. News headlines highlight LTC's stagnation around $115 while traders shift focus to emerging opportunities like Remittix presale. BTCC financial analyst James notes, 'While Litecoin faces short-term headwinds from shifting trader preferences and post-halving consolidation, its established infrastructure and adoption in payment systems provide fundamental support that aligns with our technical outlook.' The market's current preference for newer, high-growth assets creates near-term pressure, but Litecoin's proven track record and utility in remittance markets maintain its long-term viability within the cryptocurrency ecosystem.

Factors Influencing LTC's Price

Litecoin Stagnates at $115 as Traders Favor High-Growth Altcoins

Litecoin (LTC), a veteran cryptocurrency, is struggling to maintain investor interest in 2025. Priced at $115.52 with a marginal 0.11% decline, LTC's market activity has plateaued. Traders are shifting focus to faster-growing altcoins like Rollblock (RBLK), highlighting the divide between established digital assets and innovative newcomers.

On-chain data reveals a 22% drop in whale activity, signaling diminished large-scale interest. Retail transactions persist but remain insufficient to spark a rally. The broader crypto market faces headwinds, with 92 of the top 100 cryptocurrencies posting losses this week. Ethereum (ETH) bucks the trend with an 18% gain, buoyed by Layer 2 expansion optimism.

Litecoin's stability contrasts sharply with the dynamic narratives driving capital toward emerging projects. Its narrow trading band reflects a market prioritizing growth potential over reliability.

Cryptocurrency Market Declines as Bitcoin Struggles to Maintain Momentum

Bitcoin (BTC) led a broad market downturn, slipping over 1% to trade around $112,600 after failing to sustain momentum above $114,000. The sell-off dragged Ethereum (ETH) down nearly 1% to $4,278, while Solana (SOL) and Ripple (XRP) fell 2.04% and 2% respectively. Cooling demand suggests further downside risk for major digital assets.

Coinbase expanded its stablecoin offerings by listing World Liberty Financial's USD1 token. The exchange now supports full trading and custody services for the dollar-pegged asset, marking another step in institutional crypto adoption.

Litecoin’s Post-Halving Stagnation Contrasts With Remittix Presale Momentum

Litecoin's much-anticipated halving event has failed to ignite sustained price momentum, with LTC consolidating around $110 amid fading hype. The market appears to be in a 'show me' phase, requiring concrete signals before committing to directional bets.

Technical analysts note key levels to watch: $125-127.5 as immediate resistance, with $100 serving as psychological support. Historical patterns suggest halvings don't guarantee immediate upside—LTC took months to establish trends after previous events.

Meanwhile, Remittix (RTX) gains traction through transparent milestones: a confirmed exchange listing, wallet beta timeline, and visible platform development. The contrast highlights how projects with clear, tradable roadmaps can maintain momentum even as established assets like Litecoin face consolidation periods.

LTC Price Predictions: 2025, 2030, 2035, 2040 Forecasts

Based on current technical indicators and market dynamics, Litecoin demonstrates mixed but generally positive signals for long-term growth. The cryptocurrency's position above key moving averages and improving MACD momentum suggest potential for gradual appreciation, though competition from newer altcoins may cap short-term gains.

| Year | Price Prediction (USDT) | Key Drivers |

|---|---|---|

| 2025 | $145-165 | Technical breakout, adoption in payment systems |

| 2030 | $280-350 | Mainstream remittance adoption, blockchain scalability |

| 2035 | $450-600 | Institutional adoption, regulatory clarity |

| 2040 | $750-950 | Global digital payment integration, limited supply impact |

BTCC financial analyst James emphasizes that 'While these projections reflect current technical and fundamental analysis, cryptocurrency markets remain highly volatile. Litecoin's established infrastructure and specific use case in digital payments provide a solid foundation for long-term value appreciation, though investors should monitor broader market trends and regulatory developments.'